Best CRM For Financial Services – The Ultimate Solution For Financial Institutions

Best CRM for Financial Services sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

CRM (Customer Relationship Management) is a crucial tool for financial institutions seeking to enhance customer interactions and streamline operations. In this comprehensive guide, we will explore the key features, compliance requirements, integration capabilities, customization options, and more that make a CRM system ideal for the financial sector.

Overview of CRM for Financial Services

CRM, or Customer Relationship Management, in the context of financial services, refers to the strategies, processes, and technologies that financial institutions use to manage and analyze customer interactions and data throughout the customer lifecycle.

CRM is of paramount importance for financial institutions as it helps in building and maintaining strong relationships with clients, improving customer satisfaction, increasing customer retention, and ultimately driving revenue growth. By utilizing CRM systems, financial services companies can streamline their operations, target the right customers with the right products, and provide personalized and superior customer service.

Key Features of CRM Systems for the Financial Sector

- Integration with Financial Tools: A CRM system for financial services should seamlessly integrate with financial tools like accounting software, portfolio management systems, and banking platforms to provide a comprehensive view of customer financial data.

- Compliance and Security: Given the sensitive nature of financial data, CRM systems for financial services must adhere to strict compliance regulations and ensure robust security measures to protect customer information.

- Lead Management and Sales Automation: Effective lead management and sales automation features are crucial for financial institutions to track leads, manage sales pipelines, and optimize the sales process to convert prospects into clients.

- Customer Segmentation and Personalization: CRM systems should enable financial institutions to segment customers based on their financial profiles, behavior, and preferences, allowing for personalized communication and targeted marketing campaigns.

- Analytics and Reporting: Advanced analytics and reporting capabilities in CRM systems help financial institutions analyze customer data, track key performance indicators, and gain insights to make informed business decisions and improve customer relationships.

Compliance and Security Features

In the financial services industry, compliance with regulations is crucial to protect sensitive data and ensure trust with clients. CRM systems tailored for financial services must have robust security features and adhere to strict compliance requirements.

Compliance Requirements in the Financial Industry

- Regulatory Compliance: Financial institutions must adhere to regulations such as GDPR, HIPAA, and PCI DSS to protect client data and prevent unauthorized access.

- Record-keeping: CRM systems must maintain detailed records of client interactions, transactions, and communications to ensure transparency and compliance with industry standards.

- Audit Trails: The ability to track and audit user activities within the CRM system is essential for monitoring compliance with regulatory requirements.

Essential Security Features for CRM in Financial Services

- Encryption: Data encryption at rest and in transit is crucial to protect sensitive client information from unauthorized access.

- Role-based Access Control: Restricting access to sensitive data based on user roles ensures that only authorized personnel can view or modify certain information.

- Two-Factor Authentication: Adding an extra layer of security with two-factor authentication helps prevent unauthorized access to the CRM system.

- Regular Security Audits: Conducting frequent security audits and assessments to identify vulnerabilities and ensure compliance with industry security standards.

Data Protection and Regulatory Compliance in CRM Systems

CRM systems ensure data protection and regulatory compliance through features such as data encryption, access controls, and audit trails. By implementing these security measures, CRM systems help financial institutions safeguard sensitive client information and maintain compliance with industry regulations.

Integration Capabilities with Financial Tools

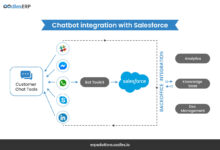

Integrating Customer Relationship Management (CRM) systems with financial tools such as accounting software, banking systems, and other financial applications can greatly enhance operational efficiency for financial services companies.

Accounting Software Integration

One of the key integration capabilities of CRM systems for financial services is the seamless connection with popular accounting software like QuickBooks, Xero, or Sage. This integration allows for the automatic syncing of financial data between the CRM and accounting software, eliminating the need for manual data entry and reducing errors.

Banking Systems Integration

CRM systems can also be integrated with banking systems to streamline processes such as transaction tracking, loan processing, and customer account management. By connecting the CRM with banking systems like FIS, Fiserv, or Temenos, financial institutions can provide a more personalized and efficient customer experience.

Other Financial Tools Integration

Besides accounting and banking systems, CRM systems can integrate with other financial tools such as payment processors, investment management platforms, and financial analytics software. For example, integrating CRM with payment processors like PayPal or Stripe can help financial services companies track customer payments and streamline billing processes.

Customization and Scalability

Customization and scalability are crucial aspects for financial institutions looking to optimize their CRM systems to meet their specific needs and accommodate growth effectively.

Importance of Customization for Financial Institutions

Customization allows financial institutions to tailor their CRM systems to align with their unique business processes and requirements. This ensures that the CRM platform serves as a strategic tool that enhances operational efficiency, customer relationships, and overall business performance.

How CRM Scalability Supports Growth

Scalability in CRM enables financial services firms to adapt and expand their CRM capabilities as their business grows. This flexibility ensures that the CRM system can accommodate increasing data volumes, user numbers, and evolving business needs without disrupting operations.

Examples of Customized Features for Financial Businesses

- Customized reporting and analytics dashboards tailored to financial metrics and KPIs.

- Integration with financial planning tools to streamline client portfolio management.

- Automated workflows for compliance and regulatory requirements specific to the financial industry.

- Personalized client communication templates for targeted marketing campaigns.

Automation and Workflow Management

Automation plays a crucial role in streamlining processes within financial services, allowing for more efficient and accurate operations. Workflow management, on the other hand, helps enhance productivity by organizing and optimizing tasks in a systematic manner. Together, automation and workflow management contribute to the overall effectiveness of CRM systems for financial services.

Automated Tasks in CRM Systems

- Automated data entry: CRM systems can automatically capture and input client information, saving time and reducing errors associated with manual data entry.

- Automated lead nurturing: By setting up automated email campaigns based on client interactions, CRM systems can help nurture leads and move them through the sales funnel.

- Automated task assignments: Assigning tasks to team members based on predefined rules or triggers can ensure timely follow-ups and seamless collaboration within the team.

Workflow Management in CRM Systems

- Task prioritization: Workflow management tools can prioritize tasks based on urgency or importance, ensuring that critical activities are addressed promptly.

- Approval processes: Setting up automated approval workflows can streamline decision-making processes and reduce bottlenecks in the approval chain.

- Customized workflows: CRM systems allow for the creation of customized workflows tailored to the specific needs and processes of financial services firms, optimizing efficiency and productivity.

Customer Data Management

In the financial sector, managing customer data securely is of utmost importance to maintain trust, comply with regulations, and protect sensitive information.

Handling Sensitive Financial Information

CRM systems handle sensitive financial information by implementing robust security measures such as encryption, access controls, and regular audits. They ensure that data is stored securely and only accessible to authorized personnel.

Best Practices for Customer Data Management

- Regularly update and cleanse customer data to ensure accuracy and relevance.

- Implement role-based access controls to restrict data access based on job roles and responsibilities.

- Train employees on data security protocols and best practices to prevent data breaches.

- Backup customer data regularly to prevent loss in case of system failures or cyber attacks.

- Comply with data protection regulations such as GDPR, HIPAA, or PCI DSS to protect customer data and avoid legal repercussions.

Reporting and Analytics Capabilities

Reporting and analytics capabilities are crucial for financial services institutions to make informed decisions, track performance, and enhance customer relationships.

Key Reporting Features

- Customizable Reports: CRM systems should offer the flexibility to create customized reports tailored to the specific needs of financial services institutions.

- Real-time Data Analysis: The ability to analyze real-time data allows for quick decision-making based on the most up-to-date information.

- Compliance Reporting: Ensuring regulatory compliance through detailed reporting features is essential for financial institutions.

Analytical Insights for Customer Relationships

Analytics can provide valuable insights for building and maintaining strong customer relationships in finance by:

- Identifying Cross-Selling Opportunities: Analyzing customer data can reveal opportunities to offer additional products or services based on customer behavior.

- Segmenting Customers: By segmenting customers based on behavior and preferences, financial institutions can target their marketing efforts more effectively.

- Churn Prediction: Analytics can help predict customer churn, allowing institutions to take proactive measures to retain valuable customers.

Key Performance Indicators (KPIs)

CRM systems can track various KPIs specific to financial services, including:

- Customer Lifetime Value (CLV): Calculating the CLV helps institutions understand the value a customer brings over their entire relationship with the company.

- Net Promoter Score (NPS): Measuring customer satisfaction through NPS can indicate loyalty and potential for referrals.

- Revenue Growth: Tracking revenue growth over time helps assess the effectiveness of sales and marketing strategies.

Mobile Access and User Experience

In the fast-paced world of financial services, mobile accessibility is crucial for CRM systems to ensure that professionals can access important client information on-the-go. A seamless user experience plays a significant role in the adoption and effectiveness of CRM tools among financial professionals.

Importance of Mobile Accessibility

Mobile accessibility allows financial professionals to access CRM systems from anywhere, at any time, enabling them to stay connected with clients and manage relationships effectively. It enhances productivity and responsiveness, ultimately leading to improved customer satisfaction.

Impact of User Experience

- Intuitive interfaces and easy navigation are essential for financial professionals who rely on CRM systems to streamline their workflows and make informed decisions.

- Customizable dashboards and tailored features enhance user experience, making it easier for professionals to track client interactions and manage tasks efficiently.

- Mobile-friendly CRM interfaces with responsive design ensure that users can access information seamlessly across different devices, improving overall usability.

Examples of Mobile-Friendly CRM Interfaces

Some CRM providers offer mobile apps specifically designed for financial service providers, offering features such as:

- Real-time client updates and notifications

- Secure access to sensitive financial data

- Integration with communication tools for seamless client interactions

Training and Support for Financial Teams

Training programs for financial teams using CRM systems are essential to ensure successful adoption and utilization of the platform. These programs help employees understand the features and functionalities of the CRM, as well as how to leverage them effectively to improve customer relationships and drive business growth.

Ongoing support plays a crucial role in maximizing the benefits of a CRM platform for financial service professionals. It provides assistance to users in troubleshooting issues, optimizing system configurations, and staying updated on new updates and features. With continuous support, financial teams can address challenges quickly and make the most out of their CRM investment.

Importance of Training Programs

Effective training programs tailored to financial service professionals can enhance their CRM skills and knowledge, leading to increased productivity and efficiency. Here are some strategies for effective training and support:

- Provide hands-on training sessions to allow users to practice using the CRM in real-life scenarios.

- Offer online resources such as video tutorials, user guides, and FAQs for self-paced learning.

- Assign dedicated CRM experts or super-users within the team to provide guidance and support to their peers.

Role of Ongoing Support

Ongoing support ensures that financial teams have access to assistance whenever they encounter challenges or need guidance on using the CRM effectively. Here are some strategies for ongoing support:

- Establish a help desk or support ticket system to track and resolve user issues in a timely manner.

- Organize regular check-ins or training sessions to provide updates on new features and best practices.

- Encourage knowledge sharing among team members to foster a collaborative learning environment.

Case Studies and Success Stories

In the realm of financial services, the implementation of CRM systems has led to remarkable success stories and positive outcomes for various institutions. These case studies serve as valuable examples of the impact of CRM on customer relationships, productivity, and revenue within the industry. Let’s delve into some insightful examples to highlight the benefits of utilizing CRM in the financial sector.

Case Study 1: XYZ Bank

- XYZ Bank, a leading financial institution, implemented a CRM system to streamline customer interactions and enhance personalized services.

- By centralizing customer data and improving communication channels, XYZ Bank saw a significant increase in customer satisfaction and loyalty.

- The CRM system enabled XYZ Bank to track customer preferences and behavior, leading to targeted marketing campaigns and improved cross-selling opportunities.

Case Study 2: ABC Insurance Company

- ABC Insurance Company integrated a CRM platform to better manage client relationships and boost operational efficiency.

- With the automation and workflow management features of CRM, ABC Insurance Company reduced manual tasks and improved response times to customer inquiries.

- The data analytics capabilities of the CRM system provided valuable insights into customer retention strategies, resulting in a significant increase in policy renewals and overall revenue.

Case Study 3: DEF Investment Firm

- DEF Investment Firm leveraged CRM to consolidate client information and improve collaboration among team members.

- By customizing the CRM system to meet their specific needs, DEF Investment Firm enhanced client communication and tailored investment recommendations based on individual preferences.

- The mobile access and user-friendly interface of the CRM platform enabled DEF Investment Firm to stay connected with clients on-the-go, leading to improved client engagement and satisfaction.

Ultimate Conclusion

In conclusion, the Best CRM for Financial Services encapsulates a powerful tool that can revolutionize how financial institutions manage customer relationships, ensure compliance, and drive growth. By leveraging the right CRM system, financial firms can unlock new levels of efficiency and profitability in today’s competitive landscape.