Cash Loan: Understanding, Applying, And Choosing Wisely

Cash loan, an essential financial tool, plays a crucial role in today’s economy. From understanding the basics to navigating through the application process, this guide will provide you with valuable insights to make informed decisions.

Exploring the various types of cash loans and weighing the pros and cons, this comprehensive overview aims to equip you with the necessary knowledge to manage your finances effectively.

Introduction to Cash Loans

A cash loan is a type of borrowing where an individual borrows a specific amount of money and agrees to repay it with interest over a predetermined period. These loans are typically unsecured, meaning they do not require collateral.

Cash loans serve as a financial lifeline for individuals facing unexpected expenses or those who need immediate funds for various purposes. They provide quick access to cash without the need for a lengthy approval process.

Types of Cash Loans

- Payday Loans: Short-term loans typically due on the borrower’s next payday, often associated with high interest rates.

- Personal Loans: Loans that can be used for any purpose, with fixed monthly payments over a specified term.

- Installment Loans: Loans repaid in fixed installments over a set period, with a predetermined interest rate.

- Title Loans: Loans secured by the borrower’s vehicle title, usually with high interest rates and short repayment terms.

- Online Loans: Loans obtained through online lenders, offering convenience and quick approval processes.

How Cash Loans Work

When it comes to cash loans, the process of obtaining one can be relatively straightforward. Here’s an overview of how cash loans typically work:

Applying for a Cash Loan

Applying for a cash loan usually involves filling out an application form provided by the lender. This form will require personal and financial information such as your income, employment status, and credit history. Once you submit the application, the lender will review your information to determine your eligibility for the loan.

Eligibility Criteria

- Proof of income: Lenders may require you to provide proof of a steady income to ensure you can repay the loan.

- Credit history: Your credit score may be taken into consideration to determine your creditworthiness.

- Collateral: Some cash loans may require collateral, such as a vehicle or property, to secure the loan.

Repayment Terms and Interest Rates

- Repayment schedule: Cash loans typically have a fixed repayment schedule, outlining when and how much you need to repay.

- Interest rates: The interest rate on a cash loan can vary depending on the lender and your creditworthiness. It’s important to understand the interest rate and any additional fees associated with the loan.

- Penalties: Failure to repay the loan on time may result in penalties or additional fees, so it’s crucial to adhere to the repayment terms.

Pros and Cons of Cash Loans

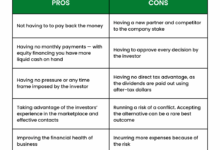

When considering taking out a cash loan, it is important to weigh the advantages and disadvantages to make an informed decision.

Advantages of Cash Loans:

- Quick Access to Funds: Cash loans provide fast access to money, which can be crucial in emergencies or urgent situations.

- No Collateral Required: Unlike some other forms of borrowing, cash loans typically do not require collateral, making them accessible to a wider range of individuals.

- Flexible Repayment Options: Cash loans often come with flexible repayment terms, allowing borrowers to choose a repayment schedule that works for them.

Drawbacks of Cash Loans:

- High Interest Rates: Cash loans can come with high-interest rates, leading to increased overall repayment amounts.

- Potential for Debt Cycle: If not managed properly, taking out multiple cash loans can lead to a cycle of debt, making it challenging to break free from financial burdens.

- Penalties for Late Payments: Missing payments or defaulting on a cash loan can result in penalties and damage to your credit score.

Comparison with Other Forms of Borrowing:

- Credit Cards: While credit cards offer convenience, they often come with high-interest rates and the temptation to overspend. Cash loans, on the other hand, provide a lump sum of money with a set repayment plan.

- Personal Loans: Personal loans typically have lower interest rates compared to cash loans, but they may require a longer application process and stricter eligibility criteria.

Factors to Consider Before Getting a Cash Loan

Before applying for a cash loan, it is crucial to assess your financial situation carefully. This will help you make an informed decision and choose the right loan that suits your needs.

Interest Rates, Fees, and Repayment Terms

When considering a cash loan, it is essential to pay attention to the interest rates, fees, and repayment terms associated with the loan. Here are some key factors to consider:

- Interest Rates: Compare the interest rates offered by different lenders to find the most competitive option. A lower interest rate can save you money in the long run.

- Fees: Be aware of any additional fees such as origination fees, late payment fees, or prepayment penalties. These can add to the overall cost of the loan.

- Repayment Terms: Understand the repayment schedule, including the frequency of payments and the total repayment period. Make sure it aligns with your budget and financial goals.

Choosing the Right Cash Loan

Here are some tips to help you choose the right cash loan for your individual needs:

- Evaluate Your Needs: Determine how much money you need and how quickly you can repay the loan. This will help you narrow down your options.

- Research Lenders: Compare different lenders and their offerings to find the most favorable terms and conditions.

- Read the Fine Print: Make sure to carefully read and understand the loan agreement, including all terms and conditions, before signing.

- Consider Alternatives: Explore other borrowing options such as personal loans or credit cards to see if they might be a better fit for your situation.

Alternatives to Cash Loans

When in need of quick cash, there are alternatives to cash loans that can be explored. These alternatives come with their own set of benefits and drawbacks, which should be carefully considered before making a decision. Here, we will compare borrowing from family/friends, using credit cards, and seeking financial assistance from non-profit organizations as alternatives to taking out a cash loan.

Borrowing from Family/Friends

When facing a financial emergency, borrowing money from family or friends can be a viable alternative to taking out a cash loan. This option may come with lower interest rates or no interest at all. However, it is essential to consider the potential strain it may put on relationships if the borrowed amount cannot be repaid on time.

Using Credit Cards

Another alternative to cash loans is using credit cards to cover immediate expenses. Credit cards offer a convenient way to access funds quickly, but it is crucial to be mindful of high-interest rates and potential debt accumulation if the balance is not paid off in a timely manner.

Seeking Financial Assistance from Non-Profit Organizations

Non-profit organizations provide financial assistance to individuals in need, offering grants or low-interest loans to help cover expenses. This option can be advantageous for those who may not qualify for traditional loans or need additional support during challenging times. However, the application process may be more rigorous, and funds may not be immediately available.

Consider these alternatives carefully to determine the best course of action based on your financial situation and needs.

End of Discussion

In conclusion, cash loans offer a convenient solution for immediate financial needs, but careful consideration and thorough evaluation are key to making the right choice. By weighing the options and understanding the implications, individuals can make informed decisions to secure their financial well-being.