Consolidation Loans: Simplifying Your Debt Repayment

Consolidation loans offer a strategic approach to managing and reducing debt burdens. By consolidating multiple debts into a single loan, individuals can streamline their repayments and potentially save on interest costs. Let’s delve into the world of consolidation loans to understand how they can benefit your financial situation.

What are consolidation loans?

Consolidation loans are financial products that allow individuals to combine multiple debts into a single, more manageable loan. This new loan typically comes with a lower interest rate and a longer repayment term, making it easier for borrowers to keep track of their finances and pay off their debts.

Benefits of consolidation loans

- Lower Interest Rates: Consolidation loans often come with lower interest rates compared to the individual debts being consolidated, resulting in potential savings over time.

- Single Monthly Payment: By consolidating multiple debts into one loan, borrowers only have to make one monthly payment, simplifying their financial management.

- Extended Repayment Term: Consolidation loans usually offer longer repayment terms, spreading out the payments over a more extended period and reducing the monthly payment amount.

- Improved Credit Score: Successfully managing a consolidation loan can positively impact a borrower’s credit score by reducing the overall debt-to-income ratio.

How consolidation loans work

When individuals opt for a consolidation loan, they apply for a new loan that covers the total amount of their existing debts. Once approved, the funds from the consolidation loan are used to pay off the original debts, leaving the borrower with only one loan to repay.

It is essential to carefully compare interest rates, fees, and terms from various lenders before choosing a consolidation loan to ensure that it will result in actual savings and better financial management in the long run.

Types of consolidation loans

Consolidation loans come in different types, each with its own set of features and requirements. Two main categories of consolidation loans are secured and unsecured loans. Let’s compare and contrast these types and explore some examples available in the market.

Secured vs. Unsecured Consolidation Loans

Secured consolidation loans require collateral, such as a home or a car, to secure the loan. This reduces the risk for the lender, allowing for lower interest rates. On the other hand, unsecured consolidation loans do not require collateral, but typically come with higher interest rates to compensate for the increased risk to the lender.

Examples of Consolidation Loans

- Home Equity Loans: These are secured loans that use the borrower’s home as collateral. They can offer lower interest rates and longer repayment terms.

- Personal Loans: Unsecured loans that can be used for debt consolidation. They are based on the borrower’s creditworthiness and may have higher interest rates.

- Balance Transfer Credit Cards: These allow you to transfer high-interest credit card debt to a card with a lower or 0% introductory APR for a limited time.

Eligibility Criteria for Consolidation Loans

Eligibility for consolidation loans varies depending on the type of loan. For secured loans, you will need to have valuable collateral and a good credit score. Unsecured loans may require a higher credit score and stable income to qualify. Lenders will also consider your debt-to-income ratio and overall financial stability when determining eligibility.

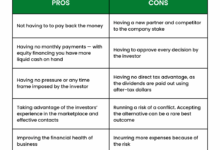

Pros and cons of consolidation loans

When considering consolidation loans, it’s essential to weigh the advantages and disadvantages to make an informed decision. Here are some key points to keep in mind:

Advantages of consolidation loans

- Streamlined payments: Consolidating multiple debts into one loan means you only have to make one monthly payment, simplifying your finances.

- Potential for lower interest rates: Consolidation loans may offer lower interest rates compared to credit cards or other high-interest debts, saving you money in the long run.

- Improved credit score: By paying off multiple debts with a consolidation loan, you can reduce your overall credit utilization ratio and potentially boost your credit score.

- Fixed repayment terms: With a consolidation loan, you’ll have a clear repayment plan with fixed terms, making it easier to budget and plan for the future.

Drawbacks of consolidation loans

- Extended repayment period: While consolidation loans may lower your monthly payments, extending the repayment period could mean paying more in interest over time.

- Risk of accruing more debt: Consolidating debts may free up available credit on your cards, leading to the temptation to accumulate more debt if spending habits are not addressed.

- Fees and charges: Some consolidation loans come with origination fees or closing costs, which can add to the overall cost of the loan.

- Impact on credit score: Applying for a consolidation loan can result in a hard inquiry on your credit report, temporarily lowering your score.

Tips to maximize the benefits of consolidation loans

- Create a budget: Develop a budget to ensure you can afford the monthly payments on the consolidation loan and avoid falling back into debt.

- Avoid new debt: Resist the temptation to use credit cards or take on new loans while paying off the consolidation loan to prevent further financial strain.

- Compare offers: Shop around for the best consolidation loan terms, including interest rates, fees, and repayment options, to find the most cost-effective solution.

- Seek financial guidance: If you’re unsure about the best approach to debt consolidation, consider consulting a financial advisor or credit counselor for personalized advice.

Applying for a consolidation loan

When applying for a consolidation loan, there are specific steps to follow to ensure a smooth process and increase the chances of approval. Understanding the requirements and preparing the necessary documentation is crucial for a successful application.

Steps to apply for a consolidation loan

- Research different lenders and compare their consolidation loan offers to find the best fit for your financial situation.

- Fill out the loan application form accurately with all the required information, including personal details, employment information, and financial data.

- Gather all the necessary documentation, such as proof of income, identification documents, bank statements, and details of existing debts to support your application.

- Submit the completed application form along with the required documents to the chosen lender for review.

- Wait for the lender to process your application, which may involve a credit check and assessment of your financial stability.

- Once approved, carefully review the terms and conditions of the consolidation loan offered, including interest rates, repayment terms, and any associated fees.

- If you agree to the terms, sign the loan agreement and arrange for the consolidation loan funds to be disbursed to pay off your existing debts.

Documentation required for a consolidation loan application

- Proof of income: Pay stubs, tax returns, or bank statements to verify your ability to repay the loan.

- Identification documents: Driver’s license, passport, or other government-issued ID for identity verification.

- Details of existing debts: Statements or accounts of current loans, credit cards, or other debts to be consolidated.

- Bank statements: To show your financial history and account balances.

- Employment information: Proof of employment, such as a letter from your employer or recent pay stubs.

Improving the chances of approval for a consolidation loan

- Improve your credit score by making timely payments on existing debts and reducing outstanding balances.

- Lower your debt-to-income ratio by paying off some debts before applying for a consolidation loan.

- Provide accurate and complete information on your application form to speed up the approval process.

- Consider adding a co-signer with a good credit history to strengthen your application and increase the likelihood of approval.

- Show stability in your employment and income to demonstrate your ability to repay the consolidation loan.

Managing debt with consolidation loans

Consolidation loans can be a valuable tool in managing multiple debts by combining them into a single monthly payment with a potentially lower interest rate. This can simplify debt repayment, reduce the total amount paid over time, and help individuals stay organized with their finances.

Strategies for effectively using consolidation loans to get out of debt

- Assess your current debts: Start by listing out all your debts, including the outstanding balances, interest rates, and minimum monthly payments.

- Compare loan options: Research different consolidation loan options to find the best terms and interest rates that will save you money in the long run.

- Create a budget: Develop a budget that includes your new consolidated loan payment to ensure you can afford the monthly payments.

- Avoid accumulating new debt: Once you consolidate your debts, avoid taking on new debt to prevent undoing the progress you’ve made.

- Stay disciplined: Commit to making your monthly payments on time and in full to effectively reduce your debt over time.

The impact of consolidation loans on credit scores

Consolidation loans can have both positive and negative impacts on credit scores. On the one hand, consolidating multiple debts can simplify repayment and reduce the risk of missed payments, which can have a positive impact on credit scores. However, opening a new credit account for the consolidation loan can temporarily lower your credit score. It’s important to continue making timely payments on your consolidation loan to maintain or improve your credit score in the long term.

Last Point

In conclusion, consolidation loans serve as a valuable tool for individuals looking to simplify their debt repayment journey. By weighing the pros and cons, understanding the types available, and effectively managing debt, one can make informed decisions to achieve financial stability. Consider exploring consolidation loans as a viable option to take control of your finances.