Instant Loans: Quick Financing Solutions For Your Needs

Instant loans offer a fast and convenient way to access funds when you need them the most. From understanding the different types available to exploring the application process, delve into this comprehensive guide to discover how instant loans can be a valuable financial tool for you.

Definition of Instant Loans

Instant loans are short-term financial solutions that are typically approved and disbursed quickly, often within the same day of application. These loans are designed to provide immediate access to funds for individuals facing urgent financial needs. Unlike traditional loans that may require extensive paperwork, credit checks, and collateral, instant loans usually have a simplified application process with minimal documentation.

Situations Where Instant Loans Are Needed

Instant loans can be helpful in various situations, including:

- Emergency medical expenses

- Unexpected car repairs

- Overdue bills or rent

- Home repairs or improvements

- Travel expenses

Features and Requirements of Instant Loans

Instant loans typically have the following features and requirements:

- Quick approval and disbursal of funds

- Short repayment period, often ranging from a few weeks to a few months

- Higher interest rates compared to traditional loans

- Minimal documentation and credit checks

- Usually unsecured, not requiring collateral

Types of Instant Loans

Instant loans come in various forms to cater to the different financial needs of borrowers. Here are some common types of instant loans available in the market:

Payday Loans

- Payday loans are short-term loans typically due on the borrower’s next payday.

- Interest rates for payday loans are usually high, making them an expensive form of borrowing.

- Repayment terms for payday loans are usually around two weeks to a month.

Personal Loans

- Personal loans offer a larger loan amount compared to payday loans.

- Interest rates for personal loans can vary based on the borrower’s credit score and financial history.

- Repayment terms for personal loans can range from a few months to several years.

Online Installment Loans

- Online installment loans provide borrowers with a fixed amount of money that is repaid in regular installments.

- Interest rates for online installment loans may be lower compared to payday loans.

- Repayment terms for online installment loans can vary from a few months to several years.

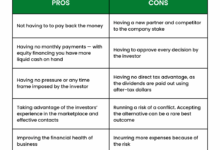

Pros and Cons of Instant Loans

When considering taking out instant loans, it is essential to weigh the advantages and disadvantages to make an informed decision. Below are the pros and cons of opting for instant loans:

Advantages of Instant Loans:

- Quick Access to Funds: Instant loans provide immediate access to funds, making them ideal for urgent financial needs or emergencies.

- Convenience: The application process for instant loans is typically straightforward and can be completed online, saving time and effort.

- No Collateral Required: Most instant loans are unsecured, meaning borrowers do not need to provide collateral such as property or assets.

- Flexible Repayment Options: Borrowers can often choose from various repayment terms that suit their financial situation.

- Potential for Improving Credit Score: Timely repayment of instant loans can positively impact the borrower’s credit score.

Drawbacks of Instant Loans:

- Higher Interest Rates: Instant loans often come with higher interest rates compared to traditional loans, increasing the overall cost of borrowing.

- Short Repayment Periods: Borrowers may have limited time to repay instant loans, leading to higher monthly payments.

- Risk of Debt Accumulation: If not managed responsibly, taking out multiple instant loans can lead to a cycle of debt and financial instability.

- Potential Scams: Due to the quick approval process, borrowers may fall victim to fraudulent lenders offering instant loans with unreasonable terms and conditions.

Tips for Responsible Use of Instant Loans:

- Only Borrow What You Need: Avoid the temptation to borrow more than necessary to prevent unnecessary debt accumulation.

- Read the Fine Print: Thoroughly review the terms and conditions of the instant loan, including interest rates, fees, and repayment terms.

- Create a Repayment Plan: Develop a realistic repayment plan to ensure timely payments and avoid defaulting on the loan.

- Consider Alternatives: Explore other options such as personal savings, borrowing from family or friends, or low-interest credit options before opting for an instant loan.

- Monitor Your Credit Score: Regularly check your credit score and report to track the impact of the instant loan on your credit profile.

Application Process for Instant Loans

When applying for an instant loan, there are specific steps that borrowers typically need to follow. The process is designed to be quick and convenient, allowing individuals to access funds in a timely manner.

Documentation and Information Required

- Personal Information: Applicants will need to provide personal details such as name, address, contact information, and identification documents.

- Employment Details: Information about employment status, income, and stability of employment may be required to assess the borrower’s ability to repay the loan.

- Bank Account Details: Applicants will need to provide bank account information for the funds to be deposited into once the loan is approved.

- Additional Documents: Depending on the lender, additional documents such as proof of residence, pay stubs, or tax returns may be requested.

Processing Time

After submitting an application for an instant loan, the approval process can vary depending on the lender. Some lenders offer instant approval where funds are disbursed within hours, while others may take a couple of business days to process the application. Once approved, the funds are typically deposited into the borrower’s bank account electronically.

Eligibility Criteria for Instant Loans

When applying for instant loans, it is important to meet certain eligibility criteria to qualify for the loan. These criteria vary depending on the lender, but there are some common requirements that individuals must typically meet. Factors such as credit score, income, employment status, and age can impact one’s eligibility for an instant loan. Below are some insights into the eligibility criteria for instant loans and ways to improve eligibility if needed.

Common Eligibility Requirements

- Minimum age requirement (usually 18 years or older)

- Stable source of income

- Good credit score (varies by lender)

- Proof of identity and residency

- Bank account for funds transfer

Factors Impacting Eligibility

- Credit score: A higher credit score improves chances of approval

- Income level: Higher income may lead to larger loan amounts

- Employment status: Stable employment increases eligibility

- Existing debts: High debt levels can affect eligibility

Ways to Improve Eligibility

- Work on improving credit score by paying bills on time

- Increase income through additional sources or part-time work

- Reduce existing debts to lower debt-to-income ratio

- Add a co-signer with a strong credit history

Ending Remarks

In conclusion, instant loans provide a prompt solution for urgent financial requirements, but it’s essential to weigh the pros and cons carefully before proceeding. By following responsible borrowing practices, you can make the most of instant loans while safeguarding your financial well-being.