Best Enterprise CRM Solutions: Streamlining Business Operations With Efficiency

Best Enterprise CRM Solutions offer a comprehensive approach to managing customer relationships in large organizations, revolutionizing the way businesses operate and thrive in a competitive landscape. Dive into the world of CRM solutions tailored for enterprises, where innovation meets functionality for optimal performance.

Overview of Enterprise CRM Solutions

Enterprise CRM solutions refer to Customer Relationship Management software specifically designed for large organizations to manage interactions with customers and potential customers. These solutions play a crucial role in streamlining processes, improving customer satisfaction, and driving business growth.

Benefits of Using Enterprise CRM Solutions

- Centralized Customer Data: Enterprise CRM solutions provide a centralized database of customer information, allowing employees across different departments to access and update customer data in real-time.

- Improved Customer Experience: By tracking customer interactions and preferences, organizations can personalize their marketing efforts and provide better customer service, leading to increased customer satisfaction and loyalty.

- Enhanced Communication: Enterprise CRM solutions enable seamless communication between sales, marketing, and customer service teams, ensuring a consistent customer experience at every touchpoint.

- Increased Efficiency: Automation features in CRM solutions streamline repetitive tasks, freeing up employees to focus on high-value activities and improving overall operational efficiency.

Examples of Industries Using Enterprise CRM Solutions

- Financial Services: Banks, insurance companies, and investment firms utilize CRM solutions to manage customer relationships, cross-sell products, and track financial transactions.

- Retail: Large retail chains leverage CRM software to analyze customer buying patterns, offer personalized promotions, and manage inventory effectively.

- Telecommunications: Telecom companies use CRM solutions to handle customer inquiries, manage service activations, and track billing information efficiently.

Features to Look for in Enterprise CRM Solutions

When selecting an Enterprise CRM solution, it is crucial to consider a range of features that can enhance the efficiency and effectiveness of your customer relationship management processes. Here are some essential features to look for in a top-notch Enterprise CRM solution:

Customization Options

Customization options are key in ensuring that the CRM solution aligns with your specific business needs and processes. Look for a CRM platform that allows you to tailor fields, workflows, and user interfaces to match your unique requirements. The ability to customize the CRM solution will enable you to optimize its functionality and improve user adoption within your organization.

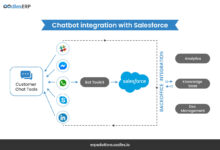

Integration Capabilities

Integration capabilities with other business tools, such as marketing automation platforms, ERP systems, and collaboration tools, are essential for a seamless flow of data and processes across your organization. A top-notch Enterprise CRM solution should offer robust integration options to connect with various third-party applications and systems. This integration capability ensures that your CRM solution can work in harmony with other tools to streamline operations and enhance productivity.

Reporting and Analytics

Comprehensive reporting and analytics features are essential for gaining valuable insights into customer behavior, sales performance, and overall business operations. Look for an Enterprise CRM solution that provides advanced reporting capabilities, customizable dashboards, and real-time analytics to track key metrics and make data-driven decisions. The ability to generate detailed reports and analyze data efficiently will empower your team to optimize strategies and drive business growth.

Scalability and Flexibility

Scalability and flexibility are crucial factors to consider when selecting an Enterprise CRM solution, especially for growing businesses. Ensure that the CRM platform can accommodate your evolving needs and scale alongside your business growth. Look for a solution that offers flexibility in terms of user licenses, storage capacity, and customization options to adapt to changing requirements and future expansion.

Mobile Accessibility

In today’s fast-paced business environment, mobile accessibility is a must-have feature for Enterprise CRM solutions. Choose a CRM platform that offers mobile applications or responsive web interfaces to enable your team to access critical customer data, update records, and collaborate on the go. Mobile accessibility ensures that your team can stay connected and productive, whether they are in the office or out in the field.

Top Enterprise CRM Solutions in the Market

When it comes to Enterprise CRM solutions, there are several top players in the market that offer a wide range of features to cater to the needs of businesses of all sizes. Let’s compare and contrast the key features of the leading Enterprise CRM solutions available, analyze their pricing models, and delve into user reviews and ratings to provide a comprehensive overview.

Salesforce

Salesforce is one of the most popular Enterprise CRM solutions known for its robust features and scalability. Some key features of Salesforce include:

- Customizable dashboards for real-time insights

- AI-powered analytics for predicting customer behavior

- Integration with third-party apps for enhanced functionality

Microsoft Dynamics 365

Microsoft Dynamics 365 is another top Enterprise CRM solution that offers seamless integration with other Microsoft products. Key features of Microsoft Dynamics 365 include:

- Unified customer view for personalized interactions

- Automated workflows for streamlined processes

- AI-driven insights for data-driven decision-making

Oracle CX Cloud

Oracle CX Cloud is a comprehensive Enterprise CRM solution that caters to a wide range of industries. Some key features of Oracle CX Cloud include:

- 360-degree customer view for personalized experiences

- Predictive analytics for forecasting customer trends

- Omnichannel support for seamless customer interactions

Pricing Models

Each Enterprise CRM vendor offers different pricing models based on factors like the number of users, features required, and level of customization. It is essential for businesses to compare pricing plans and choose the one that aligns with their budget and needs.

User Reviews and Ratings

User reviews and ratings play a crucial role in evaluating the effectiveness of an Enterprise CRM solution. By analyzing user feedback, businesses can gain valuable insights into the pros and cons of each CRM platform and make informed decisions based on real user experiences.

Implementation Strategies for Enterprise CRM Solutions

Implementing an Enterprise CRM solution in a large organization requires careful planning and execution to ensure successful adoption and integration. Here are some best practices and strategies to consider:

Best Practices for Successful Implementation

- Establish clear goals and objectives: Define what you want to achieve with the CRM system and ensure alignment with the overall business strategy.

- Involve key stakeholders: Engage decision-makers, department heads, and end-users in the planning and implementation process to gain buy-in and support.

- Customize the CRM solution: Tailor the system to meet the specific needs and workflows of your organization to maximize its effectiveness.

- Provide comprehensive training: Offer training sessions for employees at all levels to ensure they understand how to use the CRM system effectively.

Challenges and How to Overcome Them

- Data migration issues: Ensure a smooth transition of data from existing systems to the new CRM platform by conducting thorough data cleansing and validation.

- User resistance: Address resistance to change through effective communication, training, and highlighting the benefits of the CRM system for employees.

- Lack of executive support: Secure leadership buy-in by demonstrating the value and ROI of the CRM solution through regular updates and progress reports.

Tips for Employee Training

- Offer hands-on training sessions: Provide practical, interactive training sessions to help employees become familiar with the CRM system and its features.

- Create user guides and resources: Develop easy-to-follow user guides, FAQs, and tutorials to support employees in using the CRM system independently.

- Encourage feedback and continuous learning: Foster a culture of feedback and continuous improvement to enhance user adoption and utilization of the CRM solution over time.

Customization and Scalability of Enterprise CRM Solutions

Customization and scalability are crucial aspects of enterprise CRM solutions that play a significant role in meeting the specific needs of businesses and ensuring seamless growth and expansion.

Importance of Customization Options

Customization options in CRM solutions allow businesses to tailor the system to their unique requirements. This flexibility enables companies to capture relevant data, track specific metrics, and automate processes according to their workflows. For example, a manufacturing company may need CRM customization to manage inventory levels and production schedules efficiently.

Scalability Features in CRM Solutions

Scalability features in CRM solutions are essential for businesses looking to expand without major disruptions. These features enable seamless integration with other systems, accommodate a growing number of users, and manage increasing amounts of data. For instance, a retail chain can scale its CRM solution to support new store openings and manage a larger customer base without compromising performance.

Successful Customization and Scalability Implementations

One successful example of customization and scalability implementation is Salesforce CRM, which offers a wide range of customization options through its AppExchange marketplace. Companies can choose from a variety of apps and integrations to tailor their CRM system to their specific needs. Additionally, Salesforce’s cloud-based infrastructure allows for seamless scalability as businesses grow and evolve.

Overall, customization and scalability are key factors to consider when selecting an enterprise CRM solution, as they ensure the system can adapt to the evolving needs of the business and support growth without limitations.

Data Security and Compliance in Enterprise CRM Solutions

Data security is a critical aspect of Enterprise CRM solutions, especially when dealing with sensitive customer information. These systems hold a vast amount of data that must be protected from unauthorized access and breaches. In addition to security, compliance with data protection regulations such as GDPR (General Data Protection Regulation) and HIPAA (Health Insurance Portability and Accountability Act) is also essential to avoid legal consequences.

Security Features in Enterprise CRM Solutions

- Role-based access control: Enterprise CRM solutions offer the ability to restrict access to data based on user roles. This ensures that only authorized personnel can view or modify sensitive information.

- Encryption: Data encryption is used to convert sensitive information into a code to prevent unauthorized access. This ensures that even if data is intercepted, it cannot be read without the decryption key.

- Audit trails: Enterprise CRM solutions provide audit trails that track all activities within the system. This allows administrators to monitor who accessed specific data and what changes were made, enhancing transparency and accountability.

- Data masking: To further protect sensitive data, some CRM solutions offer data masking capabilities. This involves hiding or obscuring certain parts of data to ensure that only authorized users can see the complete information.

Integration Capabilities with Third-Party Applications

In today’s business landscape, seamless integration between Enterprise CRM solutions and other essential business applications is crucial for maximizing efficiency and productivity. The ability of CRM systems to work harmoniously with popular tools like marketing automation platforms, accounting software, and other third-party applications can significantly enhance CRM functionality and provide a comprehensive view of customer interactions.

Enhanced Marketing Capabilities

- Integrating CRM with marketing automation platforms allows for better alignment between sales and marketing teams, enabling targeted and personalized marketing campaigns based on customer data.

- Automated lead nurturing and follow-up processes can be streamlined, ensuring timely and relevant communication with prospects.

- Tracking and analyzing customer behavior across different platforms can provide valuable insights for optimizing marketing strategies and improving customer engagement.

Improved Financial Management

- Integration with accounting software enables seamless syncing of financial data with CRM systems, providing a complete view of customer transactions and invoicing history.

- Efficient management of billing, payments, and financial reporting processes can be achieved through automated workflows and real-time data synchronization.

- Access to up-to-date financial information empowers sales and customer service teams to make informed decisions and provide better service to customers.

Successful Integration Examples

- Integration of CRM with popular email marketing platforms like MailChimp has enabled businesses to automate email campaigns, track customer engagements, and measure campaign effectiveness.

- CRM integration with e-commerce platforms such as Shopify or Magento has facilitated seamless order processing, inventory management, and customer support, improving overall customer experience.

- Integrating CRM with project management tools like Trello or Asana has enhanced collaboration and communication within teams, leading to more efficient project delivery and customer satisfaction.

Customer Support and Service Level Agreements (SLAs)

Customer support is a critical aspect of maintaining a smooth CRM experience for enterprises. It ensures that any issues or queries that arise are addressed in a timely and effective manner, helping businesses maximize the value they derive from their CRM solutions.

Service Level Agreements (SLAs) play a crucial role in setting clear expectations between the enterprise and the CRM vendor. These agreements outline the level of support that will be provided, including response times, issue resolution timelines, and escalation procedures. By defining these parameters upfront, SLAs help ensure that enterprises receive the assistance they need when they need it, ultimately contributing to a positive user experience.

Examples of Exceptional Customer Support Experiences

- One example of exceptional customer support comes from Salesforce, a leading Enterprise CRM solution provider. They offer 24/7 support through various channels such as phone, email, and live chat, ensuring that customers can reach out for assistance at any time.

- Another exemplary case is Microsoft Dynamics 365, which provides personalized support to its enterprise customers. Their dedicated support teams work closely with businesses to understand their unique needs and offer tailored solutions to address any issues that may arise.

- Zoho CRM is also known for its exceptional customer support, with a comprehensive knowledge base, community forums, and training resources available to help users make the most of their CRM solution. Their support team is responsive and knowledgeable, providing timely assistance to resolve any queries or concerns.

Real-Life Use Cases and Success Stories

In the world of Enterprise CRM solutions, real-life use cases and success stories play a crucial role in showcasing the tangible benefits and outcomes that businesses can achieve. Let’s explore some inspiring examples of organizations that have leveraged CRM solutions to drive growth and enhance customer relationships.

Case Study 1: Company X

- Company X, a global manufacturing firm, implemented a top Enterprise CRM solution to streamline their sales processes and improve customer interactions.

- By centralizing customer data and automating sales workflows, Company X saw a 20% increase in sales productivity within the first year of CRM implementation.

- Moreover, the CRM solution enabled Company X to personalize customer interactions, leading to a 15% boost in customer retention rates.

Case Study 2: Company Y

- Company Y, a leading e-commerce retailer, adopted an Enterprise CRM solution to optimize their marketing campaigns and deliver targeted promotions to customers.

- Through advanced analytics and segmentation capabilities offered by the CRM platform, Company Y achieved a 30% increase in email open rates and a 25% rise in conversion rates.

- Additionally, the CRM solution enabled Company Y to create personalized shopping experiences, resulting in a 20% growth in average order value.

Measurable Outcomes and ROI

- Across various industries, organizations have reported significant returns on investment (ROI) after implementing Enterprise CRM solutions.

- Studies show that businesses can experience a 25-35% increase in sales productivity, a 30-40% improvement in customer satisfaction, and a 20-25% boost in revenue growth with the right CRM solution in place.

- Furthermore, companies that effectively utilize CRM solutions have seen a 50% reduction in customer service costs and a 40% decrease in sales cycle duration, leading to substantial cost savings and operational efficiencies.

Final Wrap-Up

In conclusion, Best Enterprise CRM Solutions pave the way for enhanced customer interactions, streamlined processes, and improved overall business performance. With a focus on customization, scalability, and data security, these solutions empower enterprises to achieve their strategic objectives with ease.