Loans For Bad Credit: Types, Approval Factors, Pros & Cons, Alternatives

Loans for bad credit sets the stage for this informative discussion, exploring the various types of loans available, factors influencing approval, pros and cons, and alternative options for individuals with poor credit history.

Types of Bad Credit Loans

When it comes to obtaining a loan with bad credit, there are different options available to individuals who may not qualify for traditional loans. These loans are specifically designed to cater to those with less-than-perfect credit scores, providing them with access to much-needed funds in times of financial need.

Secured Bad Credit Loans

Secured bad credit loans require collateral to secure the loan. This collateral can be in the form of a valuable asset, such as a car or a house. By offering collateral, the borrower reduces the risk for the lender, making it easier to qualify for the loan. However, if the borrower fails to repay the loan, the lender has the right to seize the collateral to recoup their losses.

Unsecured Bad Credit Loans

Unsecured bad credit loans do not require any collateral to secure the loan. These loans are riskier for lenders, as they have no guarantee of repayment if the borrower defaults. As a result, unsecured bad credit loans typically come with higher interest rates and stricter eligibility criteria. Borrowers may need to have a steady income and a decent credit score to qualify for an unsecured loan.

Eligibility Criteria

The eligibility criteria for bad credit loans can vary depending on the type of loan and the lender. Generally, lenders will look at factors such as the borrower’s credit score, income, employment history, and debt-to-income ratio when determining eligibility. Secured loans may have more lenient eligibility criteria due to the collateral involved, while unsecured loans may require a higher credit score and income level.

Factors Affecting Approval

When applying for a bad credit loan, several key factors come into play that can influence whether your application gets approved or denied. Understanding these factors is crucial to improving your chances of securing the loan you need.

Credit Score

Your credit score plays a significant role in the approval process for a bad credit loan. Lenders use your credit score to assess your creditworthiness and determine the level of risk associated with lending you money. A lower credit score indicates a higher risk for the lender, which can result in either higher interest rates or a denial of your loan application.

Income

Your income level is another important factor that lenders consider when reviewing your bad credit loan application. A stable and sufficient income demonstrates your ability to repay the loan on time. Lenders typically look at your income to debt ratio to ensure that you have enough income to cover your existing financial obligations as well as the new loan repayment.

Employment History

Having a steady employment history can also impact the approval of a bad credit loan. Lenders prefer borrowers with a stable job and steady income as it provides assurance that you have the means to repay the loan. A consistent employment record can help strengthen your loan application and increase the likelihood of approval.

Collateral

In some cases, offering collateral can help secure a bad credit loan. Collateral provides lenders with an added layer of security, as they can seize the collateral in the event that you default on the loan. This reduced risk for the lender may increase your chances of approval, especially if your credit score is low.

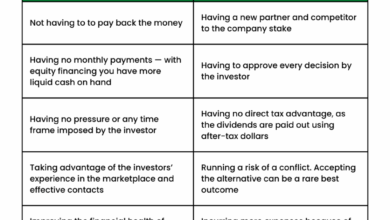

Pros and Cons of Bad Credit Loans

When considering bad credit loans, it is essential to weigh the advantages and disadvantages to make an informed decision about your financial situation.

Advantages of Bad Credit Loans

- Accessible Funding: Bad credit loans provide an opportunity for individuals with poor credit scores to access much-needed funds, which may not be available through traditional lenders.

- Improvement of Credit Score: By making timely repayments on a bad credit loan, borrowers have the chance to improve their credit score over time, demonstrating financial responsibility.

- Quick Approval: Bad credit loans often have a faster approval process compared to conventional loans, making them a suitable option for emergency financial needs.

Potential Drawbacks of Bad Credit Loans

- Higher Interest Rates: Bad credit loans typically come with higher interest rates due to the increased risk for lenders, which can result in higher overall repayment costs.

- Stricter Terms: Borrowers may face stricter terms and conditions when taking out a bad credit loan, including shorter repayment periods and lower loan amounts.

- Risk of Debt Cycle: Without proper financial management, bad credit loans can lead to a cycle of debt, especially if borrowers continue to accumulate more debt without addressing their financial habits.

Tips for Responsible Management of Bad Credit Loans

- Make Timely Payments: Ensure that you make your loan payments on time to avoid further damaging your credit score and incurring additional fees.

- Create a Budget: Develop a budget that outlines your income and expenses to manage your finances effectively and prioritize loan repayments.

- Avoid Taking on More Debt: Resist the temptation to take on additional debt while repaying a bad credit loan to prevent worsening your financial situation.

Alternatives to Bad Credit Loans

In situations where individuals have bad credit and may not qualify for traditional loans, there are alternative options available to help them access the financial assistance they need.

Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms offer a unique alternative to traditional lenders by connecting borrowers directly with individual investors. These platforms often have more flexible lending criteria, making them a viable option for individuals with bad credit. Borrowers can create a profile detailing their financial needs and risk profile, and investors can choose to fund their loan requests. This process can result in competitive interest rates and more personalized lending terms compared to traditional financial institutions.

Credit Unions

Credit unions are member-owned financial cooperatives that provide a range of financial products and services, including loans, to their members. Unlike traditional banks, credit unions often have more lenient lending criteria and may be more willing to work with individuals with bad credit. By becoming a member of a credit union, individuals can access various loan options, including personal loans, credit builder loans, and payday alternative loans. Credit unions typically offer lower interest rates and fees compared to traditional lenders, making them a cost-effective alternative for individuals with bad credit.

Last Recap

In conclusion, understanding the dynamics of bad credit loans is crucial for making informed financial decisions. By weighing the pros and cons and exploring alternative avenues, individuals can navigate their financial challenges with greater confidence and knowledge.