Online Loans For Bad Credit: Borrowing Solutions For Challenging Times

Online loans for bad credit offer a lifeline to those facing financial challenges, providing access to much-needed funds despite a less-than-perfect credit history. Explore the world of online lending tailored for individuals with bad credit and discover the options available to you.

Overview of Online Loans for Bad Credit

Online loans for bad credit are financial products specifically designed for individuals with poor credit scores. These loans are typically obtained through online lenders, offering a convenient and accessible way for people with bad credit to access funds in times of need.

Features and Requirements of Online Loans for Bad Credit

- Features:

- Quick approval process

- Higher interest rates

- Flexible repayment terms

- No collateral required

- Requirements:

- Proof of income

- Valid identification

- Bank account details

- Minimum credit score threshold

Benefits and Drawbacks of Opting for Online Loans with Bad Credit

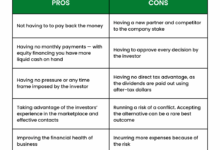

- Benefits:

- Accessibility for individuals with bad credit

- Convenience of online application process

- Quick access to funds

- Drawbacks:

- Higher interest rates compared to traditional loans

- Potential for predatory lending practices

- Risk of falling into a debt cycle

Reputable Online Lenders Offering Loans for Bad Credit

- LendingClub

- OneMain Financial

- Avant

Types of Online Loans for Bad Credit

When it comes to online loans for individuals with bad credit, there are several options available. Each type of loan has its own terms, repayment schedules, and eligibility requirements. Let’s explore the different types of online loans for bad credit and compare them to help you make an informed decision.

Installment Loans

Installment loans are a popular choice for individuals with bad credit as they allow borrowers to repay the loan amount in fixed monthly installments over a set period of time. These loans often have lower interest rates compared to other types of loans. Examples of lenders specializing in installment loans for bad credit include Avant, OppLoans, and LendingPoint.

Payday Loans

Payday loans are short-term loans that are typically repaid in full, including fees, on the borrower’s next payday. While these loans are easy to qualify for, they often come with high interest rates and fees. Lenders like CashNetUSA, Check Into Cash, and ACE Cash Express are known for providing payday loans to individuals with bad credit.

Personal Loans for Bad Credit

Personal loans for bad credit are unsecured loans that can be used for various purposes, such as debt consolidation, home improvement, or unexpected expenses. These loans typically have higher interest rates compared to traditional personal loans. Some lenders that specialize in offering personal loans to individuals with bad credit include Upgrade, OneMain Financial, and BadCreditLoans.com.

Factors to Consider Before Applying

Before applying for online loans with bad credit, individuals should carefully consider several key factors to ensure they make informed decisions. It is essential to pay attention to interest rates, repayment terms, and fees associated with the loan. Additionally, improving credit scores can increase the chances of approval and potentially lead to better loan terms.

Importance of Interest Rates, Repayment Terms, and Fees

When applying for online loans with bad credit, it is crucial to understand the impact of interest rates, repayment terms, and fees on the overall cost of the loan. Higher interest rates can significantly increase the total amount repaid, while unfavorable repayment terms may result in financial strain. Moreover, hidden fees can add to the cost of the loan and make it more challenging to repay.

- Interest Rates: Compare interest rates offered by different lenders to find the most competitive option. Lower interest rates can save you money over the life of the loan.

- Repayment Terms: Consider the length of the loan term and monthly payments. Longer loan terms may result in paying more interest over time, while shorter terms can lead to higher monthly payments.

- Fees: Be aware of any origination fees, prepayment penalties, or other charges associated with the loan. These fees can add up quickly and impact the overall cost of borrowing.

Tips on How to Improve Credit Scores

Improving credit scores can help individuals qualify for better loan terms and lower interest rates. Here are some tips to boost your credit score:

- Pay bills on time: Late payments can negatively impact your credit score, so it’s essential to make timely payments on all your accounts.

- Reduce credit card balances: Lowering your credit card balances can improve your credit utilization ratio, which is a significant factor in determining your credit score.

- Limit new credit applications: Applying for multiple new credit accounts can lower your credit score, so it’s best to only apply for credit when necessary.

- Monitor your credit report: Regularly check your credit report for errors and dispute any inaccuracies that could be dragging down your score.

Application Process and Approval Criteria

When applying for online loans for bad credit, the process typically involves filling out an online application form on the lender’s website. You will need to provide personal information, such as your name, address, income details, and employment status. Some lenders may also require you to submit documents to verify your information.

Application Process

- Fill out the online application form on the lender’s website.

- Provide personal and financial information, including income and employment details.

- Submit any required documents for verification purposes.

- Wait for the lender to review your application and make a decision.

Approval Criteria

- Lenders typically look at your credit score to determine your creditworthiness.

- Income stability and employment status are also important factors for approval.

- Some lenders may consider other aspects like debt-to-income ratio and payment history.

- Meeting the minimum age requirement and residency status may also be criteria for approval.

The approval process for online loans for bad credit can vary depending on the lender. Some lenders may provide instant decisions, while others may take a few days to review your application.

Risks and Alternatives

When considering online loans for bad credit, it is crucial to be aware of the potential risks involved. These loans often come with higher interest rates and fees, which can lead to increased debt if not managed carefully. It is essential to understand these risks and explore alternative options to make informed financial decisions.

Risks of Online Loans for Bad Credit

- High interest rates: Online loans for bad credit usually have higher interest rates compared to traditional loans, leading to higher overall repayment costs.

- Hidden fees: Some lenders may include hidden fees or charges in the loan agreement, increasing the total amount owed.

- Debt cycle: If not repaid on time, online loans can trap borrowers in a cycle of debt, making it challenging to break free from financial difficulties.

Alternatives to Online Loans

- Credit unions: Consider joining a credit union that offers more favorable terms and lower interest rates for borrowers with bad credit.

- Borrowing from family and friends: If possible, borrowing from family or friends can be a better option as they may offer more flexible repayment terms and lower or no interest rates.

- Personal loan from a bank: Explore the possibility of getting a personal loan from a bank, which may have better terms and rates than online lenders.

Tips to Avoid Falling into a Debt Trap

- Read the fine print: Always carefully review the terms and conditions of the loan agreement to understand the total cost of borrowing.

- Create a repayment plan: Develop a realistic repayment plan to ensure timely payment of the loan and avoid additional fees and charges.

- Avoid borrowing more than needed: Only borrow what you can afford to repay to prevent falling into a cycle of debt.

Conclusion

In conclusion, online loans for bad credit can be a viable solution for those in need of financial assistance, but it’s essential to weigh the benefits and risks carefully. By understanding the various types of loans, factors to consider, and alternatives available, you can make informed decisions to improve your financial situation.