Quick Loans: Accessing Fast Financial Solutions

Quick loans provide a swift way to access financial assistance, designed to meet urgent needs without the hassle of traditional bank loans. Explore the world of quick loans and discover how they can offer a convenient solution to your financial requirements.

What are Quick Loans?

Quick loans are short-term loans that are designed to provide borrowers with fast access to funds in times of urgent financial need. These loans are typically processed quickly, with minimal paperwork and requirements, making them a convenient option for individuals facing unexpected expenses or cash shortages.

Typical Features of Quick Loans

- Fast Approval: Quick loans are known for their speedy approval process, often providing funds within a few hours or days.

- Short Repayment Period: These loans usually have a short repayment term, ranging from a few weeks to a few months.

- Higher Interest Rates: Due to their quick disbursement and minimal requirements, quick loans often come with higher interest rates compared to traditional loans.

- Accessible to Borrowers with Poor Credit: Some quick loan options are available to individuals with less-than-perfect credit scores.

Types of Quick Loans Available

- Payday Loans: Short-term loans that are typically due on the borrower’s next payday, with high fees and interest rates.

- Personal Loans: Unsecured loans that can be used for various purposes, with quick approval and funding.

- Online Installment Loans: Loans repaid in fixed installments over a set period, usually with quick approval and funding.

- Cash Advances: Short-term loans offered by credit card companies or lenders, usually with high fees and interest rates.

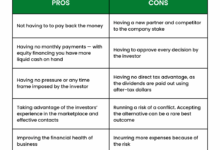

Pros and Cons of Quick Loans

When considering taking out a quick loan, it is important to weigh the advantages and disadvantages to make an informed decision.

Advantages of Quick Loans

- Quick Approval: Quick loans have a fast approval process, allowing borrowers to access funds promptly in times of urgent need.

- Convenience: The application process for quick loans is typically simple and can often be done online, saving time and hassle.

- No Collateral Required: Many quick loans are unsecured, meaning borrowers do not need to provide collateral to secure the loan.

- Flexible Repayment Terms: Some quick loan providers offer flexible repayment options, making it easier for borrowers to manage their finances.

Potential Drawbacks of Quick Loans

- Higher Interest Rates: Quick loans often come with higher interest rates compared to traditional bank loans, which can result in higher overall costs for the borrower.

- Shorter Repayment Period: Quick loans typically have shorter repayment periods, which may lead to higher monthly payments and potential financial strain.

- Risk of Predatory Lenders: Some quick loan providers may engage in predatory lending practices, leading to debt traps for unsuspecting borrowers.

- Impact on Credit Score: Failing to repay a quick loan on time can negatively impact the borrower’s credit score, making it harder to access credit in the future.

Comparison with Traditional Bank Loans

- Accessibility: Quick loans are often more accessible to individuals with less-than-perfect credit scores, as they rely on different criteria for approval compared to traditional bank loans.

- Speed: Quick loans are processed much faster than traditional bank loans, making them a suitable option for those in need of immediate funds.

- Amount Limit: Traditional bank loans may offer higher loan amounts compared to quick loans, which may be more suitable for larger financial needs.

- Interest Rates: Traditional bank loans generally have lower interest rates than quick loans, which can result in lower overall costs for the borrower in the long run.

Eligibility Criteria for Quick Loans

When applying for quick loans, it is important to meet certain eligibility criteria in order to increase your chances of approval. Understanding the common requirements and how credit scores impact the approval process can help you improve your eligibility for quick loans.

Common Requirements for Quick Loans

- Proof of income: Lenders typically require applicants to provide proof of a steady income to ensure they can repay the loan.

- Identification: You will need to provide a valid ID to verify your identity.

- Age requirement: Most lenders require applicants to be at least 18 years old.

- Bank account: You may need to have an active bank account for the loan funds to be deposited into.

Impact of Credit Scores on Approval Process

Your credit score plays a crucial role in the approval process for quick loans. Lenders often use credit scores to assess the risk of lending to an individual. A higher credit score can increase your chances of approval and may even qualify you for lower interest rates. On the other hand, a low credit score may result in higher interest rates or even rejection of your loan application.

Tips to Improve Eligibility for Quick Loans

- Check your credit report: Make sure to review your credit report for any errors or inaccuracies that could be negatively impacting your score.

- Pay off existing debts: Lowering your debt-to-income ratio can improve your credit score and make you a more attractive borrower.

- Increase your income: If possible, consider taking on additional work or finding ways to boost your income to show lenders that you have the means to repay the loan.

- Shop around: Compare offers from different lenders to find the best terms and rates that suit your financial situation.

Applying for Quick Loans

When applying for quick loans, it is essential to follow a step-by-step process to ensure a smooth and efficient application. Understanding the documentation needed and knowing how to choose the right quick loan provider can significantly impact your borrowing experience.

Step-by-Step Process of Applying for a Quick Loan

- Research Different Lenders: Start by researching and comparing different quick loan providers to find the one that best suits your financial needs.

- Check Eligibility Criteria: Review the eligibility criteria of each lender to ensure you meet the requirements before applying.

- Prepare Required Documents: Gather all necessary documentation, such as proof of income, identification, and bank statements, to support your loan application.

- Fill Out Application: Complete the application form provided by the lender accurately and honestly.

- Submit Application: Once you have filled out the application form and attached the required documents, submit your application to the lender.

- Wait for Approval: The lender will assess your application and inform you of their decision, which could be approval or rejection.

- Receive Funds: If your application is approved, the funds will be disbursed into your bank account, usually within a few business days.

Documentation Needed When Applying for Quick Loans

- Proof of Income: Pay stubs, bank statements, or tax returns to demonstrate your ability to repay the loan.

- Identification: Government-issued ID, such as a driver’s license or passport, to verify your identity.

- Bank Statements: Recent bank statements to show your financial history and stability.

- Utility Bills: Some lenders may require proof of residence, such as utility bills in your name.

Insights on How to Choose the Right Quick Loan Provider

- Interest Rates: Compare interest rates offered by different lenders to ensure you are getting the best deal.

- Reputation: Research the lender’s reputation by reading reviews and checking their accreditation to avoid scams or predatory lending practices.

- Terms and Conditions: Read and understand the terms and conditions of the loan agreement, including fees, penalties, and repayment schedules.

- Customer Service: Choose a lender that provides excellent customer service and support throughout the loan application process.

Interest Rates and Repayment Terms

When considering quick loans, it is crucial to understand the interest rates associated with them and the repayment options available. Managing repayment effectively is key to avoiding financial stress.

Typical Interest Rates

Quick loans often come with higher interest rates compared to traditional loans due to the convenience and speed they offer. The interest rates can vary depending on the lender, the amount borrowed, and the repayment term.

Repayment Options

- Fixed Repayment Plan: In this option, you agree to repay a fixed amount at regular intervals until the loan is fully paid off. This provides predictability and helps you budget effectively.

- Flexible Repayment Plan: Some lenders offer the flexibility to adjust your repayment schedule based on your financial situation. This can be useful if you encounter unexpected expenses.

- Early Repayment: If you have the means, consider repaying the loan early to save on interest costs. However, be sure to check if there are any prepayment penalties.

Strategies for Managing Repayment

- Create a Budget: Make a budget that includes your loan repayments to ensure you can meet them without compromising other financial obligations.

- Avoid Borrowing More Than You Need: Only borrow what you truly need to minimize the total amount you have to repay.

- Communicate with Lender: If you encounter difficulties in repaying, don’t hesitate to contact your lender to discuss possible alternatives or solutions.

- Avoid Rollovers: Try to avoid extending the loan term or rolling over the loan as it can lead to additional fees and higher overall costs.

Alternatives to Quick Loans

When considering borrowing money, quick loans may not always be the best option for everyone. It is essential to explore alternative financing options that may better suit your financial needs and situation. Let’s take a look at some alternatives to quick loans:

Credit Cards

Using a credit card can be an alternative to quick loans, especially for smaller expenses. Credit cards offer a revolving line of credit that can be used for purchases or cash advances. However, it is important to manage credit card debt responsibly to avoid high-interest charges.

Personal Lines of Credit

A personal line of credit is another option to consider instead of quick loans. Similar to a credit card, a personal line of credit provides access to a predetermined amount of funds that can be used as needed. Interest is only charged on the amount borrowed, making it a flexible borrowing option.

Other Forms of Borrowing

Other forms of borrowing, such as borrowing from family or friends, tapping into savings, or utilizing assets as collateral for a loan, can also be considered as alternatives to quick loans. These options may have lower interest rates or more favorable terms compared to traditional quick loans.

It is important to carefully evaluate your financial situation and needs before choosing the right borrowing option. Quick loans may offer fast access to cash, but they also come with high-interest rates and fees that can add up quickly if not managed properly. Consider exploring these alternative financing options to make an informed decision that aligns with your financial goals.

Final Wrap-Up

In conclusion, quick loans offer a practical and efficient way to address immediate financial needs. By understanding the features, pros, and cons of quick loans, you can make informed decisions when seeking financial assistance.